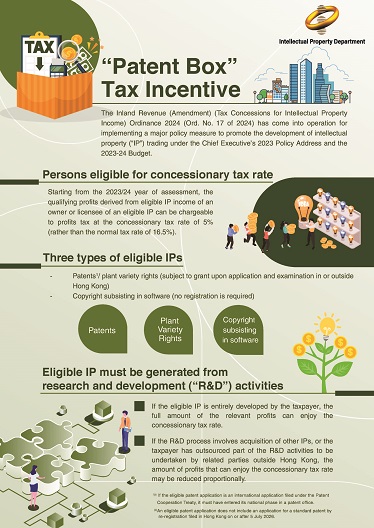

To encourage the industrial and R&D sectors, creative industries and IP users to engage in more IP trading activities, the Government has implemented the “patent box” tax incentive. The tax rate for assessable profits from eligible IP income derived from eligible IPs (i.e. patents, plant variety rights and copyright subsisting in software) has been reduced from 16.5% to 5%.

The relevant legislation has come into effect on 5 July 2024.